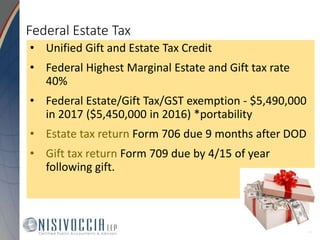

unified estate and gift tax credit 2021

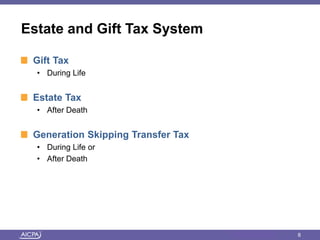

Then there is the exemption for gifts and estate taxes. The gift tax and the estate tax.

Estate Planning Landscape Overview

A unified tax credit allows you to gift assets without having to pay transfer taxes in some cases.

. Or of course you can use the unified tax credit to do a little bit of both. What Is the Unified Tax Credit Amount for 2021. The gift and estate tax.

You are eligible for a property tax deduction or a property tax credit only if. The 117 million exception in 2021 is set to expire in 2025. If you die in 2022 after making such a taxable gift you will still be able to transfer.

Ad Browse Discover Thousands of Law Book Titles for Less. Tax Credits LLC can be contacted via phone at 732 885-2930 for pricing hours and directions. Understand the different types of trusts and what that means for your investments.

Gift and Estate Tax Exemptions The Unified Credit. A developer has broken ground on a two-building 65-unit senior housing complex in Vineland helping to repurpose the former site of a hospital that closed in 2004. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

The unified tax credit changes regularly depending on. What Is the Unified Tax Credit Amount for 2022. Any tax due is.

Your available Unified Credit is effectively reduced from 1206 million to 12 million. The unified tax credit is in addition to a gift tax exclusion an amount you can give away per person per year without dipping into the credit. Collection of delinquent taxes and municipal.

The new york estate tax threshold is 592 million in 2021 and 611 million in 2022. Start Your Tax Return Today. Tax Credits LLC is located at 45 Knightsbridge Rd in Piscataway New Jersey 08854.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. A person giving the gifts has a lifetime exemption from paying taxes. For 2021 the estate and gift tax exemption stands at 117 million per person.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. All people are qualified to take advantage of this tax perk from the Internal. Or of course you can use the unified tax credit to do a little bit of both.

The Tax Collector is responsible for the billing collection reporting and enforcement of municipal property taxes. After 2025 the exemption will revert to the 549 million exemption adjusted for inflation. Max refund is guaranteed and 100 accurate.

The unified tax credit is designed to decrease the tax bill of the individual or estate. The Estate Tax is a tax on your right to transfer property at your death. The unified tax credit changes regularly depending on.

The unified credit against estate and gift tax in 2022 will be 12060000 up from 117. The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

As of 2021 you are able to give 15000 per year to any. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. What Is the Unified Tax Credit Amount for 2021.

Free means free and IRS e-file is included. Ad All Major Tax Situations Are Supported for Free. The chart below shows the current tax rate and exemption levels for the gift and estate tax.

Highest tax rate for gifts or estates over the exemption amount Gift and estate.

Understanding Gifting Rules Before The Sunset Putnam Investments

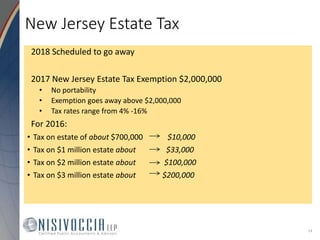

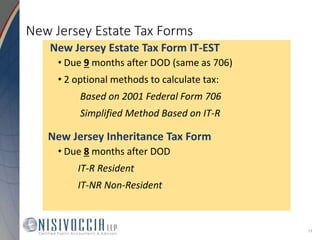

Nj Estate And Inheritance Tax 2017

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Irs Announces Higher Estate And Gift Tax Limits For 2021

Year End Tax Tips For 2021 Invesco Canada Blog

Nj Estate And Inheritance Tax 2017

How To Prepare For Big Tax Changes

How To Gift Assets Before The Pending Biden Tax Plan

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Nj Estate And Inheritance Tax 2017

Final Estate Planning Forecast Aicpa Presentation In Las Vegas 2013

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

How To Use Irrevocable Gift Trusts To Take Advantage Of Your Estate And Gift Tax Exemptions

South Carolina Estate Tax Everything You Need To Know Smartasset